How AION can fuel your M&A Success

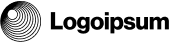

AI-Powered Matchmaking

Accelerating deal flow with our AI-powered platform

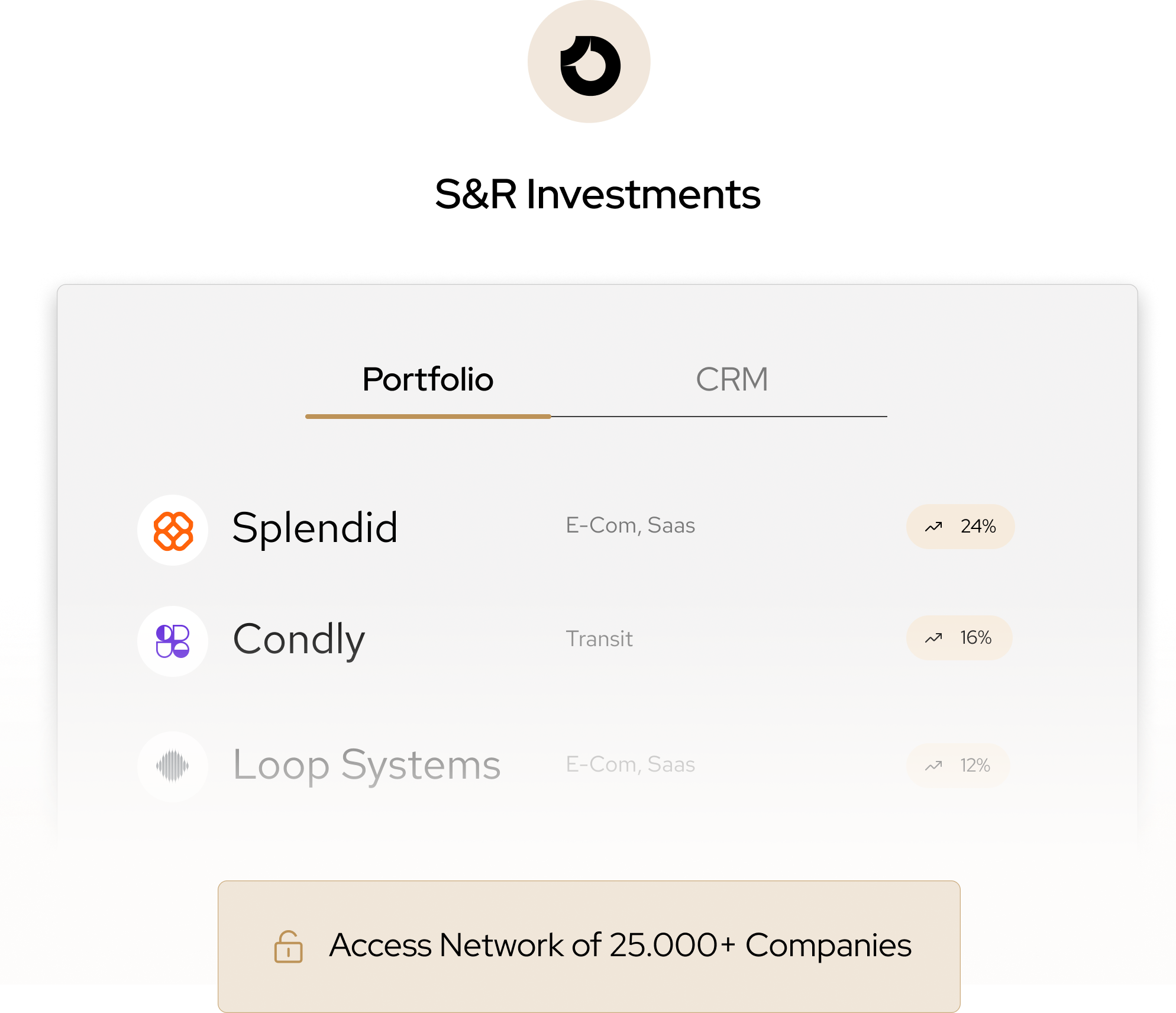

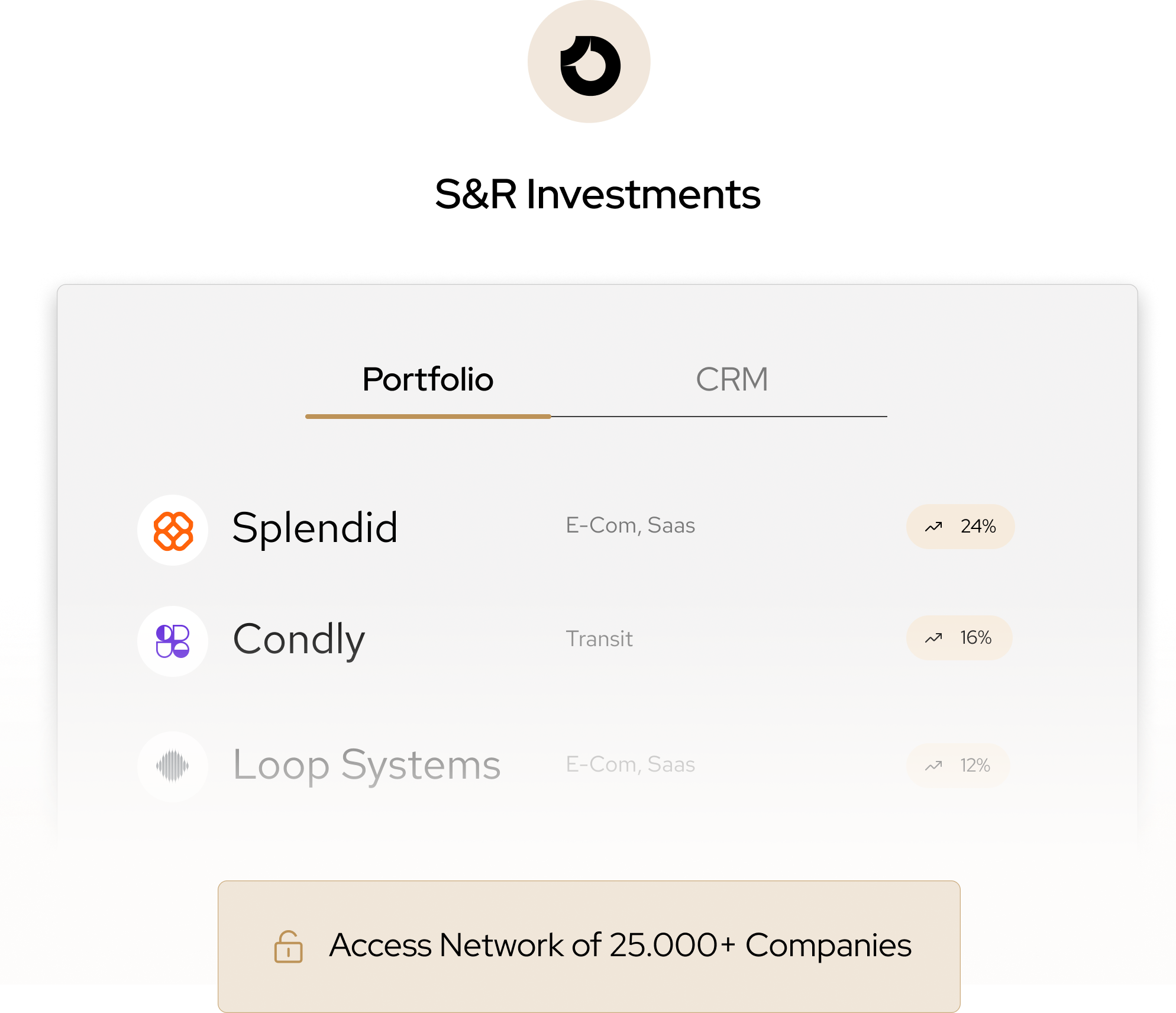

THE PLATFORM

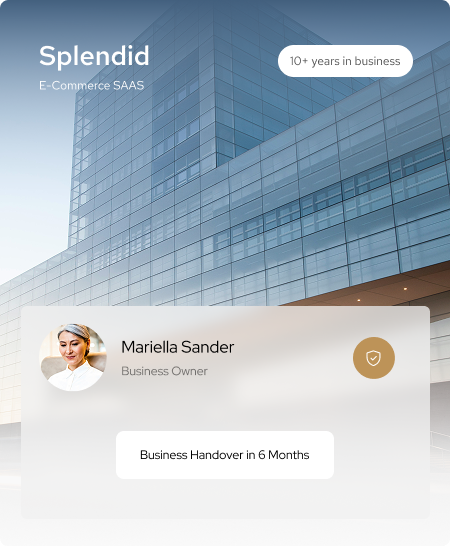

Over 25.000 verified companies

Discover deals before they hit the market

+8

+8

HOW IT WORKS

Get started right away - it’s free.

AION is free of charge and risk until deal closing. We charge a 5% fee upon successful closing

Sign Up and choose your profile type

Create your profile and specify your preferences for the European market.

Choose your Goal

Set your goals—whether you’re selling, buying or sourcing deals—and let our AI instantly recommend the most relevant opportunities.

Verify your Account to get more insights

Complete your verification to unlock full analytics, premium data and direct messaging.

Sign Up and choose your profile type

Create your profile and specify your preferences for the European market.

Choose your Goal

Set your goals—whether you’re selling, buying or sourcing deals—and let our AI instantly recommend the most relevant opportunities.

Verify your Account to get more insights

Complete your verification to unlock full analytics, premium data and direct messaging.

Frequently Asked Questions about Business Succession

Browse our FAQs for quick clarity on how Aion streamlines your M&A journey or Contact our team today and get personalized support.

Reach out

• Company valuation by certified M&A advisors

• Preparation of financial documents and due diligence materials

• Legal structure optimization

• Identification and approach of potential successors or buyers

• Tax advisory to optimize the transaction

• Small companies: Simpler structure, shorter transaction times

• Mid-market companies: More complex due diligence, more professional buyer structures

• Large companies: Comprehensive legal and tax reviews, longer transaction times

• Realistic price expectations

• Negotiation basis with potential buyers

• Tax planning

• Financing structures AION as specialized M&A advisory uses established valuation methods such as DCF, multiple methods, and comparable company analysis .

• Strategic buyers from the industry

• Financial investors and Private Equity

• Management Buy-out (MBO) or Buy-in (MBI)

• Family-internal succession

• Employee participation (ESOP) Professional M&A advisors have corresponding networks and databases .

Strategic Process of an M&A Transaction at AION

Explained in 9 phases